开云APP官网注册 位于浙江省湖州市和孚工业园区,具有活力的“长三角”太湖岸。公司创建于2002年,占地面积16亩,总投资3000万,是一家致力于发展农、林、生活垃圾等废弃物循环利用设备制造的企业,是国家生物质能先进企业,拥有发明zhuanli60多项,是湖州市zhuanli示范企业、省级工业新产品和中国低碳经济十大示范单位,有130年制炭历史的综合性生产高新企业。

公司对制炭业、生物质利用、节能有着深厚的底蕴和全新的理念。公司始终坚持产、学、研一体化的发展战略

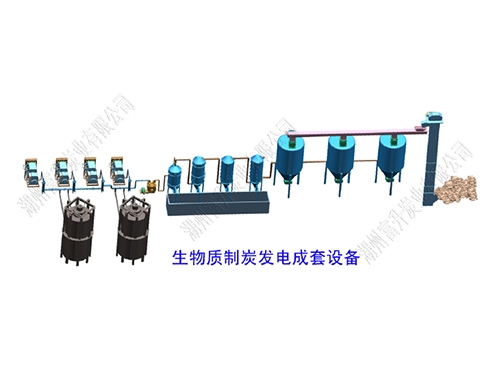

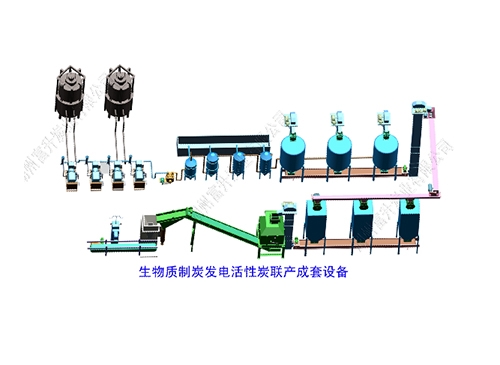

产品中心

机制木炭的六个好处